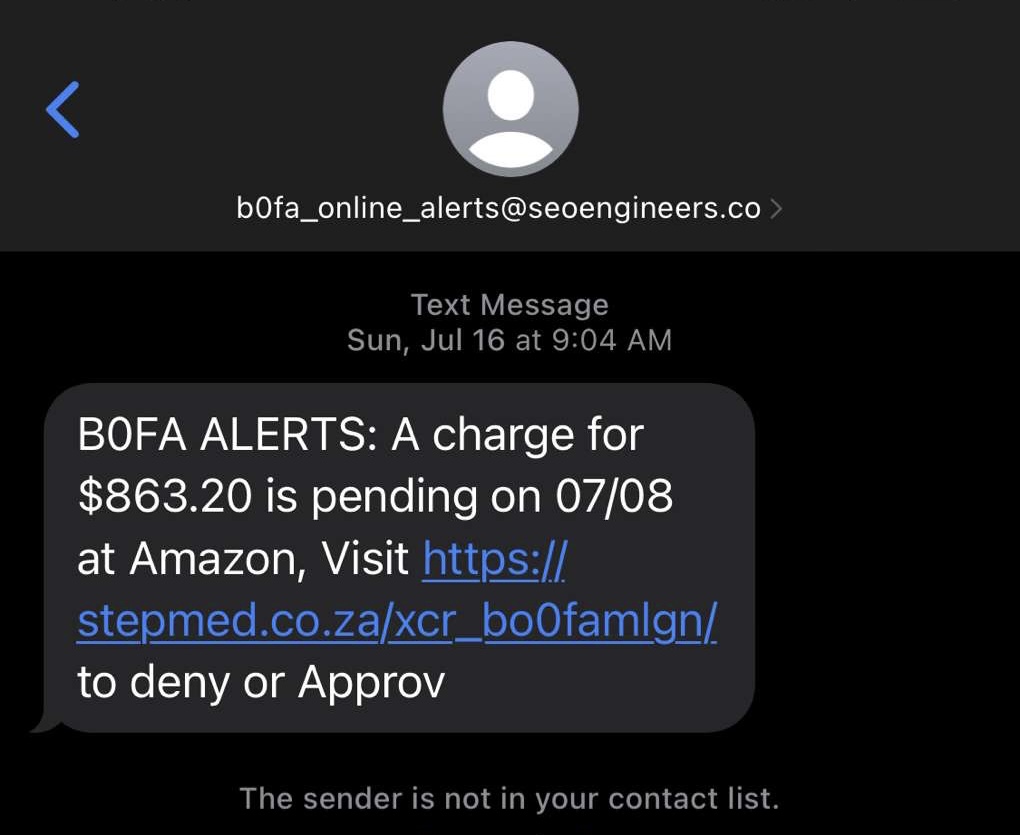

Picture this, you just received a message from “b0fa_online_alerts” that states, “A charge for $863.20 is pending on 07/08 at Amazon. Visit (link) to deny or Approv.”

Some people will recognize that this is a scam and a hacker is waiting for you to type information or even just click the link they sent you. Others, in the heat of the moment, click the link and become a victim of a banking scam.

While social media, money transferring and sending cash through apps are becoming popular in our society today, so, too, is a new form of hacking.

Online banking has become the preferred way to monitor and transfer funds. The most common way to send money online is through apps such as Cashapp, Venmo, Paypal or Zelle, an exclusive Bank of America online tool. All these apps are the most convenient way to pay someone back or ask for money without using physical bills.

What makes them popular for many users? Apps such as these can be used in many cases like asking for one check when eating out with someone and then paying them back as compared to asking for separate checks. They work very well, they are fast and convenient, and most phones have access to at least one of these apps.

However, there are plenty of risks involved if you choose to use a money transferring app or have important information stored online. Sometimes hackers live darkly within these apps just waiting to pounce.

Risks to anyone

Before you act, you have to ask yourself; is this legitimate?

A common scam that has affected many victims is being tricked by fraudsters. In fact, according to CBS News, since 2021, Americans have lost $2.7 billion dollars from scams online. All a fraudster needs is to combine bank details such as a social security number (SSN) or a card number and they can access your account and start stealing money or sending money to themselves.

In this case, there is little chance you can get money refunded once it is sent to someone else. So unless you accidentally sent money to a friend and you can communicate to get it back, that money you sent will be gone forever.

Social media scams are also becoming very popular among hackers. How people get hacked most of the time is when someone has a friend on an app such as Instagram and their friend messages them usually starting with a greeting. Then, by the end, they ask for money. The hackers ask you to click a link for a “phone number” or a link to “pay them,” but they end up hacking your account all together.

“One of my close friends had messaged me asking me to click a link they sent that had something to do with their new phone number, and without hesitation I clicked the link.” said Blake Tapia (25’).

How to prevent hacks

Social Media is the easiest to prevent. If you are ever alerted about a potential hacker by email or message, The solution is simple. Just go into the actual app and make your password more secure. Do not click links sent by text or email because you could be typing your information right into a hackers trap. If a friend is messaging you asking for a favor or asking for money on social media, talk to them by phone as a default. Or, alternatively, message app or talk to them in person to make sure they haven’t been a victim of hackers.

For preventing banking apps or even being a victim of having your card information stolen, the first thing to do is to stay aware. The bank will NEVER call you asking about personal information or information about your card.

The next thing is to be cautious of messaging a friend who has been hacked. Most of the time, if a friend is hacked the way the hacker talks through their messages is very different from how the real person would talk. Recognize that difference. Then, if they ask for money or send a link with little context, assume it is a red flag and do not continue.

According to Mia Roberson (‘22’), a second year Cyber Security major at The University of Alabama, hackers move at their own pace to get victims to act before thinking.

Roberson said, “Hackers or scammers will have a sense of urgency. They’ll want to move fast, and want you to send money or take action fast.”

In the U.S, one in every ten adults become victims of scams or fraud. Don’t let that one in ten be you.